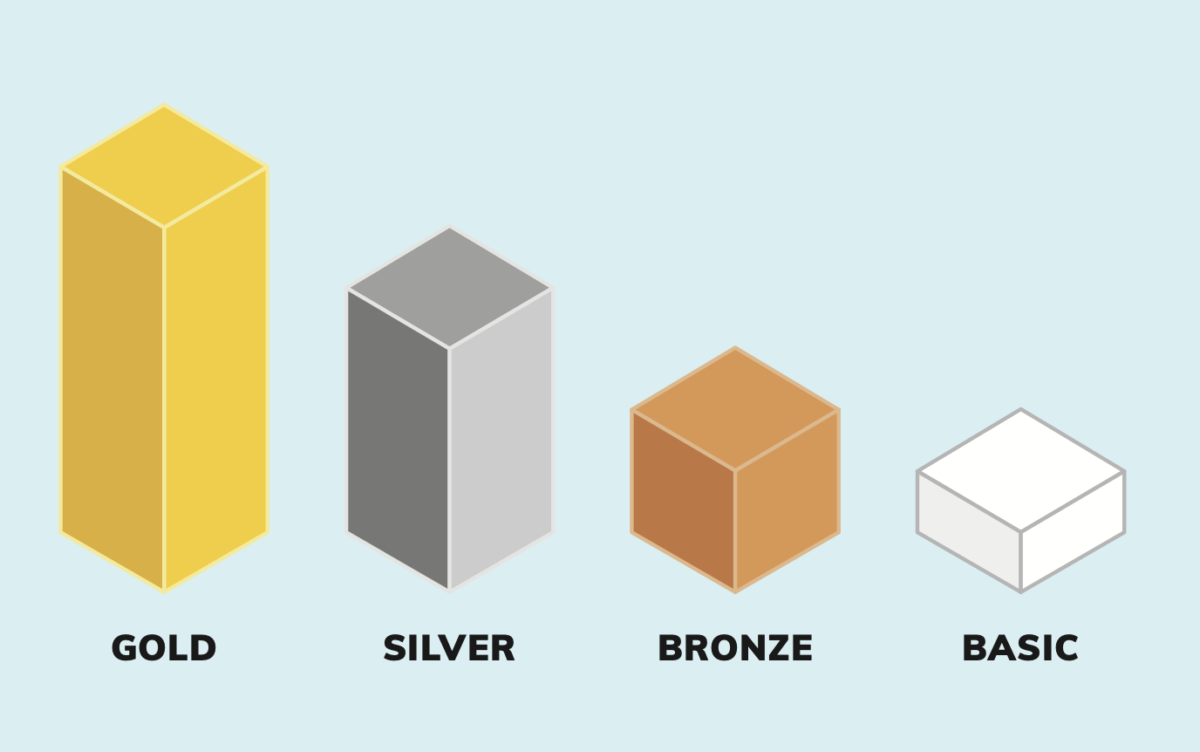

In 2020 the Government introduced reforms to make understanding private health insurance simpler and assist consumers to choose the right hospital cover best suited to their requirements. Private health funds were required to change their hospital classifications to Gold, Silver, Bronze or Basic.

Gold hospital cover gives you the confidence that your health needs are supported and protected whatever stage of life you’re at. Some examples of treatments you may need to undergo are:

- cataract surgery

- joint replacements

- spinal fusions

- dialysis for chronic kidney disease

- weight loss surgery

- chronic illness

- or simply planning to start a family

Have you heard of Gold cover? It’s one of the four types of private health insurance that offers the highest level of care and covers a broad range of treatments. Although it may come at a higher cost than Basic, Bronze, or Silver policies, it could potentially save you money in the long term.

So, what does Gold tier insurance actually cover? Well, it covers all medically necessary in-hospital treatments and procedures, including rehabilitation, psychiatric services, and palliative care, as well as treatments covered under Silver and Bronze policies. In addition to this, it also provides access to clinical treatments like the ones mentioned above.

But that’s not all! Gold tier insurance also covers private health insurance general treatment or extras cover services such as dental treatment, ambulance services, chiropractic treatment, home nursing, podiatry, physiotherapy, occupational therapy, speech therapy, glasses, and contact lenses as long as you have a extras package combined with your hospital cover.

Who is the Gold tier cover best suited for? Individuals with chronic or ongoing health issues, women planning on getting pregnant and wanting to give birth as a private patient in a private hospital, patients with cancer or heart issues, individuals needing dialysis for chronic kidney disease or access to insulin pumps, active people prone to injury, and older persons requiring joint replacements, hearing implants, or cataract treatment can all benefit from Gold tier cover.

Find the best gold tier health coverage today by visiting https://health.compare/ or speak to one of our friendly team members call 1300 861 413 / email hello@health.compare