When it comes to medical cover there is a question that’s on most people’s minds, will Medicare cover me or will I need a private health insurance cover? Medicare is our public health scheme providing free or subsidised healthcare to all Australians that are permanent residents. Medicare is made up of three main areas: hospital, medical and pharmaceutical.

Each eligible person in Australia is issued a Medicare card to present every time you see a doctor, go to hospital, or get a medical test done.

Comparing private health insurance plans with Medicare is the best way to ascertain whether you will have the correct cover and whether you require a mix of both Medicare and private health to give you the most affordable private health insurance. In this month’s blog we will cover everything you need to keep in mind when making your final decision.

The Advantages of Medicare

No Cost to You – supplemented by the Australian Government

- medical services provided by doctors, specialists, and other health professionals (if your doctor bulk bills, you won’t have to pay for anything)

- Free or at a lower cost prescription medicine

- Save money on medical costs by registering your family for the Medicare Safety Net

What is covered by Medicare

Medicare partially or fully covers:

- seeing a GP or specialist

- tests and scans, like x-rays

- most surgery and procedures performed by doctors in the public system

- eye tests by optometrists

For instance, when you are visiting your GP and they have a bulk billing service, Medicare will cover the costs of the visit and you will not have any out-of-pocket expenses. It’s always a good idea at the time of booking to ask your medical practice if they bulk bill and if not enquire how much you will get back as a rebate from the overall fee.

A great reference tool to find a practitioner that bulk bills can be found here, simply choose the service required and add your postcode or location. It will also give you an idea of what providers offer a competitive charge so you have a comprehensive health plan.

What’s not covered by Medicare

Unfortunately, Medicare does not cover ambulance levies so you will need to find and organise an Ambulance provider or make sure you’re covered through a private health policy for this service.

Other items not covered under the Medicare scheme:

- hearing devices

- workers’ compensation check-ups or life insurance

- in home nursing assistance

- most dental services

- Chinese medicine, alternative therapies, or complementary medicine (unless it has been ordered by a doctor)

- Glasses and contact lenses.

About the Medicare Safety Net

A provider of larger rebates to those that have substantial healthcare costs, the Medicare Safety Net offers further assistance with out-of-pocket costs. For example, when you spend a certain amount on healthcare over the course of a year and reach the Medicare Safety Net threshold, Medicare will provide a larger rebate for a wide range of services, including:

- biopsies

- blood tests

- healthcare professional consultations

- pap smears

- psychiatry

- radiotherapy

- scans

- ultrasounds

- x-rays.

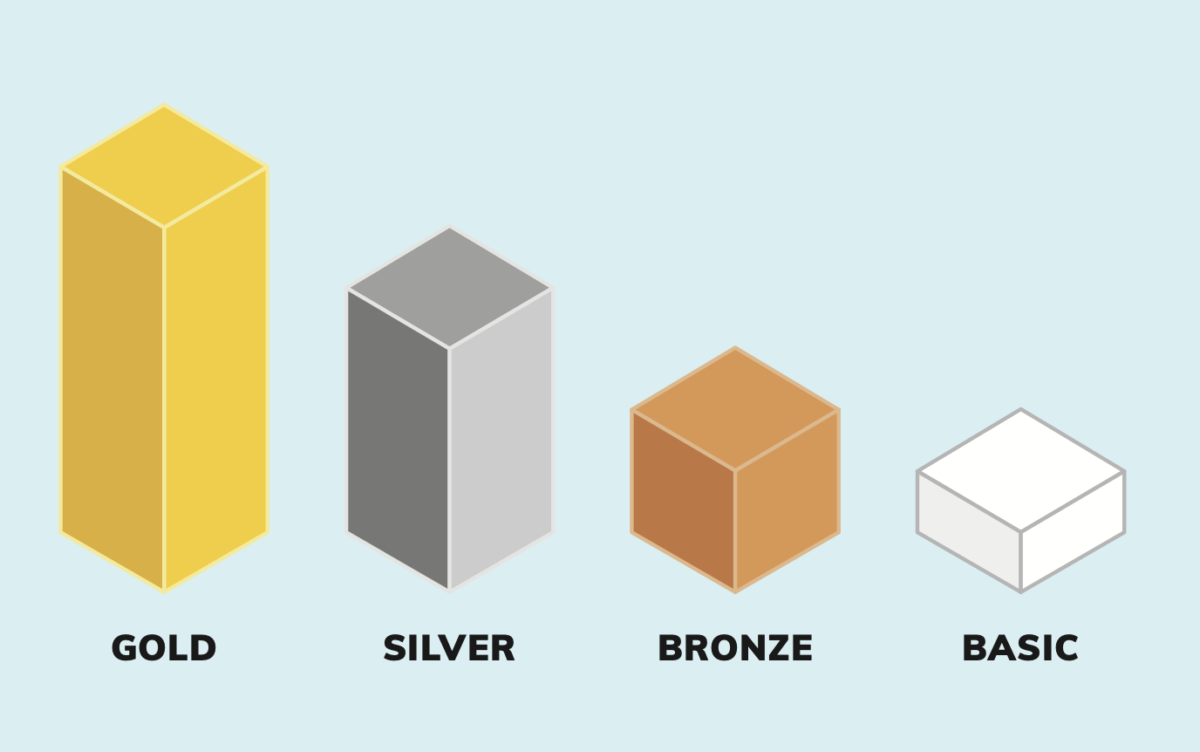

Mixing Medicare with Private Health Insurance

Even if you have private health insurance you can still access benefits from Medicare. Some customers opt to have their hospital insurance through their private health fund which allows you to have treatment in a private hospital or as a private patient in a public hospital. The private health system is divided into three areas: hospital, extras, and ambulance.

Advantages of private health cover:

- Nominate your own doctor/ specialist

- Less waiting time for non-elective surgeries

- Choice of hospital

Private health insurance doesn’t cover:

- GP visits

- some specialist visits

- visits to hospital emergency departments, both public and private

- any x-rays or other scans

- any blood tests or other pathology tests.

It’s all about Affordability

Whether you can afford to pay for private health insurance is a big factor. You may choose only to have Medicare cover, due to the cost of private health cover. It really comes down to your budget and what works best for your financial situation. Medicare is still a great alternative option for your health and well-being.

Some important things to keep in mind

If require non-urgent, elective surgery or treatment the waiting times can be longer in the public Medicare system. So, choosing a private health policy that will cover your surgery and speed up the process may be something to think about.

Chat to us Today

To compare private health insurance – speak to one of our team members today on 1300 861 413 or email us hello@health.compare