Do you play sport? What you need to know about sport and Private Health Insurance

Sports and physical activity play a vital role in maintaining good health and well-being. Not only do they both help to improve physical fitness and reduce the risk of chronic diseases, but they also have a positive impact on mental health and overall well-being. However, for many, the cost of potential injury from participating in sport and physical activity can be a barrier. This is where private health cover can assist. In this blog post, we will discuss what you need to know to find the best health coverage for any sport related treatments and injuries and what private health insurance you will need to be covered adequately. Also, we’ll include a list of the benefits that private health insurance has for sports-related injuries and the different types of cover available.

Naturally private health insurance is valuable for the overall population, however private health can be even more critical for athletes, sports players, and regular gym goers. As these activities can sometimes aggressive or dangerous in nature, athletes are prone to more injuries than the general population.

What are the most common Sports injuries?

Overall, there is a lot to consider when it comes to sport and private health cover, but with the right information and resources, individuals can make informed decisions and ensure that they have the best possible coverage and support for their sports-related needs.

Here’s a list of potential injuries can sports people and athletes incur:

⦁ Sprains and strains

⦁ Bone fractures and dislocations

⦁ Concussions and head injuries

⦁ Knee injuries, such as ACL tears

⦁ Shoulder injuries, such as rotator cuff tears

⦁ Back and spinal injuries

⦁ Hand and wrist injuries

⦁ Foot and ankle injuries

⦁ Dislocations and dislocations

⦁ Soft tissue damage, such as tears in muscles, tendons, and ligaments.

How to choose the right private health policy for sports-related injuries?

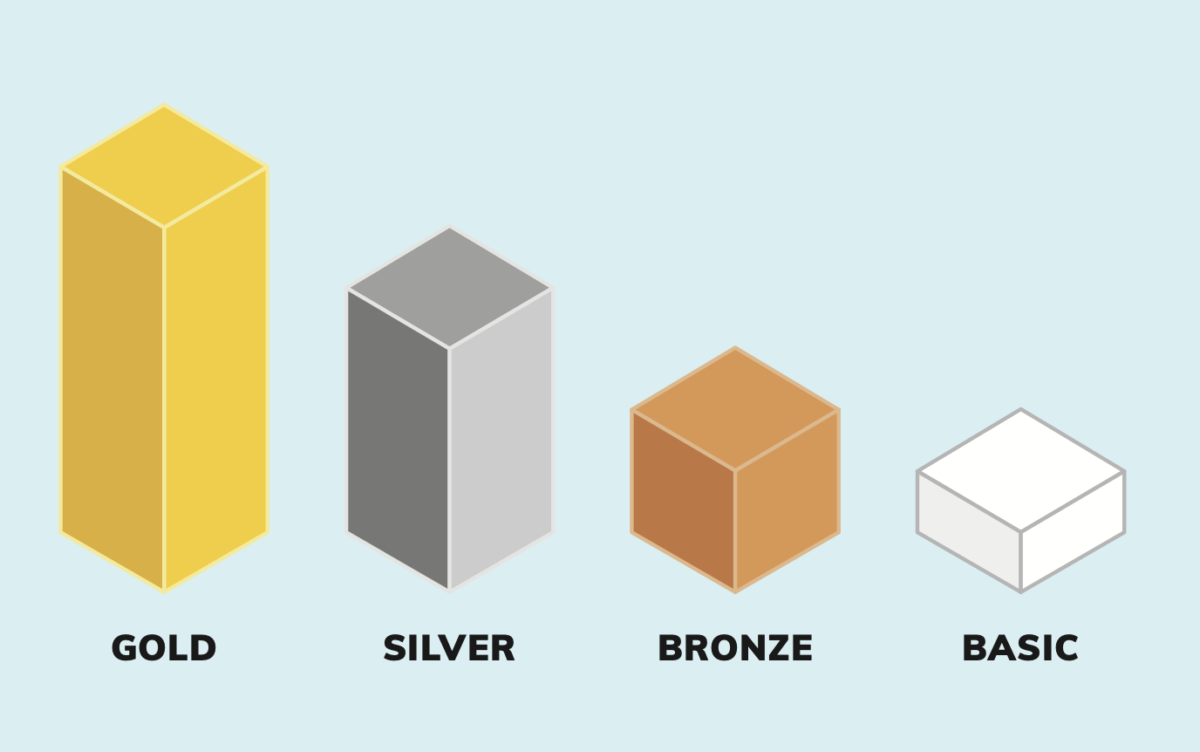

It’s a good idea as an athlete or sportsperson to assess the nature of your sport (i.e. Intensity and frequency of participation) to determine what private health coverage you will need. The health fund will also consider your previous injuries and pre-existing aliments. So be sure to check the fine print and waiting periods for these issues to make sure you are covered.

One of the main benefits of private health insurance for sports people is that it can provide access to specialised treatment and rehabilitation services that may not be available through the public healthcare system. This can include things like physiotherapy, sports psychology, knee operations and rehabilitation and even specialised sports clinics. Additionally, private health insurance may also help to cover the cost of surgeries and other medical procedures that may be necessary to treat sports-related injuries.

Another important consideration for individuals is the issue of pre-existing conditions and sports participation. In many cases, individuals with pre-existing conditions may have difficulty obtaining private health insurance coverage for sports-related injuries. This can sometimes be overcome by serving a longer waiting period on the service required. However, it is important to note that there are several options available for individuals with pre-existing conditions, including coverage through the public healthcare system although the wait times may be much longer. Additionally, it is important to shop around and compare private health insurance plans

to ensure that you are getting the best coverage for your needs.

What treatments will be covered under my private health insurance policy?

Because private health policies may not cover all potential or likely sports risks, those who participate in sports activities often should consider additional supplemental health insurance options to ensure that they are truly covered in the event of an accident or sports injury.

⦁ Acupuncture

⦁ Ambulance

⦁ Chiropractic

⦁ Dental

⦁ Elective surgery

⦁ Massage

⦁ Naturopathy

⦁ Osteopathy

⦁ Podiatry

⦁ Physiotherapy

⦁ Private hospital

⦁ Rehabilitation

In addition to private health insurance, there are numerous other resources available to sports enthusiasts, including government-funded sports programs, community sports clubs, and professional sports organisations. These resources can provide access to training, equipment, and other resources that can help to prevent sports-related injuries and promote overall health and wellness.

Will Medicare cover any sports related medical care?

Sports related surgeries are usually deemed non-emergency by Medicare. In other words, most sporting injuries that require surgery will lead to elective surgeries under Medicare. The wait time for Medicare elective surgeries can span over months or even years depending on the severity of your injury.

While Medicare alone may be adequate for some, those who are active with sports may find that they face out-of-pocket costs when using Medicare alone. Athletes must consider their individual circumstances and sporting activity to determine if Medicare alone will suffice or if additional private health coverage is needed.

In conclusion, private health insurance can be an important resource for athletes and sports enthusiasts, providing access to specialised treatment and rehabilitation services to help cover the cost of surgeries and other medical procedures. However, it is important to consider a number of factors when choosing a private health insurance plan, including budget, waiting periods, and pre-existing conditions.

Reach out to us today and find the best health coverage that suits your sporting lifestyle.

To compare private health insurance speak to one of our friendly team members on 1300 861 413 or hello@health.compare